JAQUELINE: Mr Turnbull, your jobs and growth mantra is based on the trickle-down economics theory. Your former employer Goldman Sachs and many other trusted sources have raised serious concerns about this tax cuts and confirmed that a significant proportion of the windfall will benefit overseas investors, shareholders and not trickle down at all. Over 10 years the plan will cost the Australian taxpayer in the vicinity of $50 billion. Why should ordinary Australians support cuts to our services to give companies a tax cut that according to so many experts probably won't create jobs or contribute to growth significantly and elsewhere has been shown to increase inequality in society?

Malcolm Turnbull: Well Jaqueline thank you. Firstly let me say that cutting company tax does not increase inequality in society. There has been a long trend towards reducing company tax right around the world. The biggest cutter of company tax in our lifetimes is in fact Paul Keating, who cut company tax twice and he cut it because he knew that if you reduced company tax, if you reduced business tax, you increase the return on investment. If you increased the return on investment, you get more investment. If you get more investment, you get more employment and you get more growth. That's why the Treasury found last year that for every dollar cut in company tax, you got $4 of benefit of growth into the economy, into GDP of which between two-thirds and three quarters went to labour, went to workersTreasury produced a report on 3 May this year "Analysis of the long term effects of a company tax cut" that models the two options for funding the planned company tax cut.

While Malcolm Turnbull said "Firstly let me say that cutting company tax does not increase inequality in society", the Treasury modelling of his "jobs and growth" plan says the exact opposite -

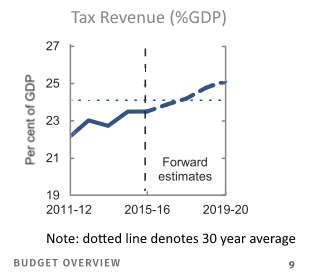

The way to fund its company tax cut that the Coalition selected, as shown in its 2016/17 Budget Overview4. COMPANY INCOME TAX CUT FINANCED BY A PERSONAL INCOME TAX INCREASE

In this section a reduction in company tax rate from 30 to 25 per cent is financed by an increase in the average rate of personal income tax.

Theory and key assumptions

The personal income tax system includes the taxation of both labour and capital income. It is difficult to incorporate progressivity in a model with a single representative household, so the modelling reported here assumes a single effective tax rate (hereafter average personal income tax) that is applied to labour income and capital income after franking credits. Progressivity potentially raises the excess burden of a tax, which implies the modelled average personal income tax increase may understate the welfare cost of raising revenue via the actual personal income tax system. As noted in Section 3, the perfect capital market and fixed domestic saving rate assumptions imply the capital income component of the personal income is largely invariant to changes in personal tax rates. Therefore, the distortionary part of the modelled personal income tax is effectively the labour income tax component.

…

5. COMPANY TAX CUT FINANCED BY A GOVERNMENT SPENDING CUT

In this section a reduction in the company tax rate from 30 to 25 per cent is financed by a cut to government spending.

Theory and key assumptions

Government spending is assumed not to affect directly the welfare of households. In the previous two scenarios real government spending was held constant so adding it to the household utility function would not have made any difference to the welfare calculations reported there. In the current scenario, the implicit assumption is that all government spending that is cut is wasteful. While this is a common modelling assumption it ignores the fact that: government spending provides goods and services [Medicare bulk-billing for instance] that would otherwise not be provided by the market sector; households derive direct utility from government spending; and infrastructure spending can improve market sector productivity. This suggests the model will overstate the benefits of this funding alternative. This scenario is expected to yield significantly higher welfare gains than the previous two scenarios because an additional assumed distortion is removed from the economy.

|

| The Coalition Plan - Higher and Higher Personal Income Taxes |