Natural Gas and Coal Seam Gas

|

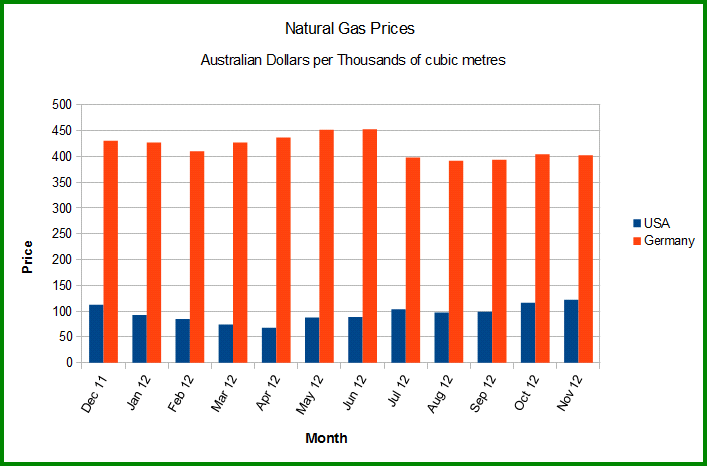

| Natural Gas Prices Planned for Australia "Export Parity" in Red Bars, USA Price in Blue Bars |

The Australian Energy Market Operator web site lists wholesale prices for natural gas.

These are listed in Australian dollars per gigajoule ($/GJ).

The wholesale price of natural gas in Victoria on 7 January 2013 was about $3 per GJ.

This is equivalent to approximately $111 per 1,000 cubic metres - virtually the same as the US natural gas price at the Henry Hub (the blue bars in the above chart).

|

| AEMO - Victorian Wholesale Natural Gas Market Data 7 January 2013 |

The Australian Institute of Energy web site is offline at present.

The following is the first few items from a web archive copy -

Australian Institute of Energy

Oil & Gas Special Interest Group

Interesting and Useful Articles

House of Representatives, Standing Committee on Economics

Inquiry into Australia' Oil Refinery Industry

This inquiry into Australia's oil refining industry is about to commence. At time of writing, 21 submissions had been published. Readers with interests in oil refining will find these submissions of value.

Read/download submissions

An analysis of coal seam gas production and natural resource management in Australia.

Williams J., Stubbs T., and Milligan A. October 2012. A report prepared for the Australian Council of Environmental Deans and Directors by John Williams Scientific Services Pty Ltd, Canberra, Australia.

There has been no greater influence on Australia's energy markets than coal seam gas since production began over 40 years ago of natural gas and crude oil.

This commercial development has ensured that the East Coast again had adequate supplies of natural gas, sufficient enough to lay the foundations for a large LNG industry in Gladstone and that domestic natural gas prices will in future reflect export parity for LNG, the same concept as import parity for crude oil.

In order to ensure that this development was managed well, an Independent Expert Scientific Committee on CSG is being established under COAG. This report is the most independent, disinterested nationwide analysis yet undertaken and makes two key findings:

- Firstly, the environmental risks, especially with groundwater, are serious, and neither decommissioning wells nor replenishing aquifers have been properly considered and

- Secondly, this is another land use which needs to be regulated than like all others.

Copyright

Read/download this report

James Fazzino is the managing director and chief executive of Incitec Pivot.

The following are extracts from two articles he has written critical of the Australian Government policy on natural gas pricing.

Government should ensure gas is made available for local manufacturing

BY: JAMES FAZZINO From: The Australian October 01, 2012Australia has abundant supplies of natural gas but we have the only national government in the world that doesn't give priority to local use, both for downstream processing and for Australian homes.

We have allowed major oil and gas companies to control the use of the gas so that export contracts to Japan and China get priority.

This means that there is either no gas for Australian manufacturing or, at best, gas is made available at up to four times the current price. We are being asked to pay virtually the same price for Australian gas as energy-starved Japan and China.

This is not the global market price because gas is essentially traded in a series of local markets. Only 9 per cent of the world's gas is traded globally. The result is that Australian manufacturing plants will close, hundreds of workers will lose their jobs and Australian household energy bills will skyrocket.

Read this report

Incitec Pivot chief James Fazzino says ALP's failed to take advantage of the gas boom

BY: JAMES FAZZINO From: The Australian July 27, 2012INCITEC Pivot chief James Fazzino has accused the Gillard government of lacking the vision to take advantage of its gas interests.

"For me, it's illogical and short-sighted that Australia is not leveraging our abundant gas resources for the greater national interest," he told an American Chamber of Commerce in Australia lunch in Sydney yesterday.

Mr Fazzino said there were fundamental differences between how Australia and the US viewed the access and affordability of energy, in particular gas reserves. "The US sees its gas reserves as an enabler for value-added manufacturing, and this is revitalising their economy," he said.

Mr Fazzino said the US proposed developing its energy reserves in support of manufacturing jobs, but Australia had "naively allowed the unfettered export" of gas and was missing a big opportunity to retain gas reserves, or at least a larger portion of them, onshore.

Read this report

0 comments:

Post a Comment