Australia recently examined the development of a hydrogen industry -

Briefing Paper: Hydrogen's for Australia's Future.

Converting hydrogen to methane can reduce CO

2 emissions from electricity generation - in the short term at least - while production capacity of hydrogen is growing.

The arithmetic analysis.

If a region is considering thermal power options to provide electricity, two options may be:

- Three coal-fired power plants running at 40% efficiency or

- Two combined-cycle gas turbine power stations running at 60% efficiency.

An assumption is that each power plant consumes fuel with the same amount of chemical energy.

Because the coal-fired power plants are only two-thirds as efficient as the combined-cycle gas turbine power plants, a third coal-fired power plant is needed to produce the same electricity output as the two combined-cycle gas turbine power plants.

The CO

2 emissions are about 900 grams per kilowatt-hour generated for the coal-fired power plants and only 310 grams per kilowatt-hour for the combined-cycle gas turbine power plants.

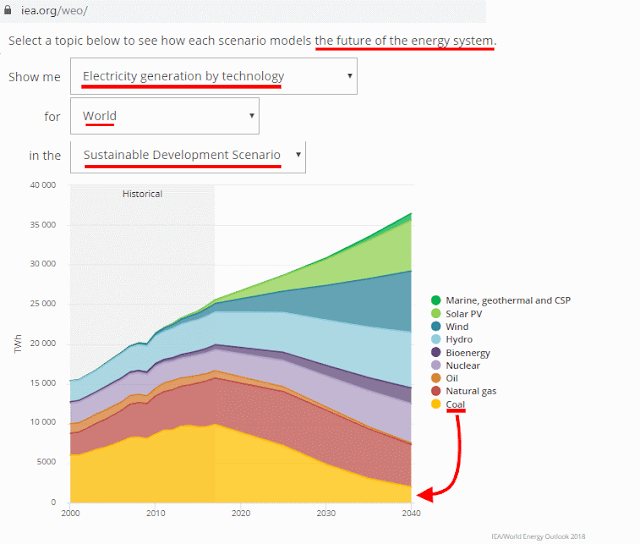

NOTE: A reduction of two-thirds use of coal by 2030 is required to limit global warming to 1.5°C.

This ratio of CO2 emissions of 310 to 900 grams per kilowatt-hour is equivalent to a 65% reduction in coal use.

If sufficient hydrogen was produced to fuel one combined cycle gas turbine power plant, when three coal-fired power plants were the option being used, then one and a half coal-fired plants could be idled. This would cut coal-use in half and cut CO2 emissions from electricity generation in half. Average CO2 emissions for all electricity generation - from the coal-fired plants and the hydrogen-fueled combined cycle gas turbine power plant - would be 450 grams per kilowatt-hour.

However, if the same amount of hydrogen was reacted with carbonaceous material, such as coal, to produce synthetic methane, the resulting fuel would be sufficient to run two combined cycle power plants: all three coal-fired plants could be shut down. This would cut coal-use by two-thirds and cut CO2 emissions from electricity

generation by two-thirds. Average CO2 emissions for all electricity generation

- from the synthetic methane-fueled combined cycle gas

turbine power plant - would be 310 grams per kilowatt-hour.

This process results in a greater cuts in CO

2 emissions. It also doubles the energy value that the hydrogen possessed before it was combined with carbon to form methane.

That is, it is preferable from both commercial and environmental perspectives.

The benefits are greater than just the cuts in CO

2 emissions arising from electricity generation.

In December 2018 the Australian Government released a document on projected CO

2 emissions -

Australia’s emissions projections 2018.

This shows substantial fugitive emissions arise from natural gas production and from coal mining.

Out to 2030, several LNG plants are expected to source gas from new basins as current feed gas sources deplete.

As the percentage of CO2 is higher for some of these new feed gas sources the overall emissions intensity

of Australia’s LNG projections increases which increases emissions.

Fugitive emissions for natural gas (other than LNG) are projected to be 17 million tonnes of CO

2-e each year from 2018 to 2030. The fugitive emissions from LNG production are projected to rise from 11 million tonnes of CO

2-e a year in 2018 to 13 million tonnes of CO

2-e a year in 2030.

The Australian Government's

National Greenhouse Accounts Factors - July 2017 shows fugitive emissions from open cut coal mines in NSW are 200 times greater per tonne of raw coal mined than those of open cut coal mines in Victoria. The brown coal available in Victoria is also far cheaper than thermal coal mined in NSW.

As an indication of the amounts of fugitive emissions involved: Australia burns about 60 million tonnes of black coal a year for electricity generation. If sourced from open cut NSW coal mines, the fugitive emissions would be 60 million x 0.054 = 3.24 million tonnes of CO

2-e.

Total electricity generated in Australia from black coal in 2016-2017 was about 120 thousand gigawatt-hours. At an emission intensity of 900 grams of CO

2-e per kilowatt-hour (1 gigawatt-hour is 1 million kilowatt-hours), the generation of this much electricity from black coal would result in annual emissions of about 108 million tonnes of CO

2-e.

In 2016-2017 Australia also burned about 57 million tonnes of brown coal to generate about 44,000 gigawatt-hours of electricity. At an emission intensity of 1,100 grams of CO

2-e per

kilowatt-hour (1 gigawatt-hour is 1 million kilowatt-hours), the

generation of this much electricity from brown coal would result in

annual emissions of about 44.8 million tonnes of CO

2-e.

The conversion of brown coal to synthetic methane with hydrogen would be commercially attractive in upgrading the value of this low-cost fuel stock and environmentally superior - cutting fugitive emissions that arise in both coal-mining and natural gas production.